|

News from the National Academy of Elder Law Attorneys (NAELA): Enrollment in Medicare Advantage plans has grown substantially in the past few decades, enticing more than half of all eligible people, primarily those 65 or older, with low premium costs and perks like dental and vision insurance. However, as the private plans’ share of the Medicare patient pie has ballooned to 30.8 million people, so too have concerns about the insurers’ aggressive sales tactics and misleading coverage claims.

Enrollees who sign on when they are healthy can find themselves trapped as they grow older and sicker. “It’s one of those things that people might like them on the front end because of their low to zero premiums and if they are getting a couple of these extra benefits — the vision, dental, that kind of thing,” said Christine Huberty, a lead benefit specialist supervising attorney for the Greater Wisconsin Agency on Aging Resources. “But it’s when they actually need to use it for these bigger issues,” Huberty said, “that’s when people realize, ‘Oh no, this isn’t going to help me at all.’” Medicare pays private insurers a fixed amount per Medicare Advantage enrollee and, in many cases, also pays out bonuses, which the insurers can use to provide supplemental benefits. Huberty said those extra benefits work as an incentive to “get people to join the plan” but that the plans then “restrict the access to so many services and coverage for the bigger stuff.” David Meyers, assistant professor of health services, policy, and practice at the Brown University School of Public Health, analyzed a decade of Medicare Advantage enrollment and found that about 50 percent of the beneficiaries — rural and urban — left their contract by the end of five years. Most of those enrollees switched to another Medicare Advantage plan rather than traditional Medicare. In the study, Meyers and his co-authors muse that switching plans could be a positive sign of a free marketplace but that it could also signal “unmeasured discontent” with Medicare Advantage. SOURCE/MORE: Click This Link Good news for Medicare Prescription Drug Beneficiaries: More Medicare Prescription Drug Help in 202412/20/2023

The Inflation Reduction Act of 2022 (IRA), signed into law by President Biden on August 16, 2023, is already providing cost savings for Medicare beneficiaries in 2023, including a monthly cap of $35 for covered insulin and free vaccines for certain conditions. In January 2024, even more beneficial changes are starting. As noted on the www.medicare.gov website:

In addition, the drug price negotiation program created by the IRA allows Medicare to use its bargaining power to negotiate the prices of prescription drugs for the first time. The pattern of lowered cost continues in 2025, when the annual Part D out-of-pocket cap will be decreased to $2,000. Individuals will also have the option to pay out-of-pocket costs in monthly amounts over the plan year, instead of when they happen. SOURCE/MORE: CENTER FOR MEDICARE ADVOCACY>> The Administration for Community Living (ACL)’s Eldercare Locator and Disability Information & Access Line (DIAL) are trusted resources that help connect older adults and people with disabilities with resources in their community. In recent days, Eldercare Locator has noted a significant increase in people reporting they have been targeted by scam phone calls. This includes reports of callers claiming to be from “Eldercare,” “Eldercare Locator,” “Social Security,” or “Medicare”; callers asking for personal information such as someone's Social Security number, banking information, or Medicare number; and callers demanding payment, threatening jail time, or fines.

Here are some important reminders:

Older adults who are targeted by scams and fraud can call the Department of Justice’s National Elder Fraud Hotline at 1-833-FRAUD-11 (1-833-372-8311). In addition, scams and fraud targeting people of any age can be reported to the Federal Trade Commission (FTC) by calling 1-877-FTC-HELP (1-877-382-4357) or visiting reportfraud.ftc.gov. SOURCE/MORE: ADMINISTRATION FOR COMMUNITY LIVING>> Most attorneys will recommend separate trusts for couples in separate-property states such as Virginia (as opposed to community property states such as California), although there are a few reasons why couples may want to consider joint trusts.

Reasons to Choose a Joint Trust Over a Separate Trusts in a Separate Property State Joint trusts are consistent with clients’ view of marital assets Many spouses see a joint trust as more consistent with their views of marital property. Instead of treating each asset as “his” or “hers,” all assets are viewed as “ours” by virtue of their inclusion in a single joint trust. This allows clients to avoid the sometimes-contentious process of deciding how marital assets should be divided to fund separate trusts. Joint trusts involve the creation of only one trust instrument, which may save attorneys’ fees Clients often view joint trusts as a cheaper alternative to a two-trust estate plan. Whether this will be true depends on the estate planning attorney’s fee structure. Drafting a joint trust can—in some circumstances—be a more time-intensive undertaking than drafting two separate trusts, and many attorneys charge accordingly. Regardless of whether the attorney actually charges less for a joint trust, many clients believe that the fees should be less because the attorney is only preparing one document instead of two. Ease of administration during lifetime If both spouses are bringing relatively the same amount of assets into the marriage and don’t have significant issues with creditors to worry about, a joint revocable living trust would be the easiest solution during their lifetimes. Creating a joint trust may save time and costs to set up and fund as they are typically more straightforward than setting up separate trusts. You may also save extra steps when it’s tax time each year by not having to have an individual tax return for your spouse’s trust and yours. Reasons to Choose a Separate Trust Over a Joint Trusts in a Separate Property State In separate-property states, separate trusts will often be the better choice for married couples with a sweetheart estate plan (at the death of the first spouse, all is left to the surviving spouse, then to the children at the death of the surviving spouse). The benefits of enhanced asset protection, ease of administration, and greater flexibility usually outweigh the psychological benefit of a joint trust. Enhanced asset protection As a general rule, assets held in a revocable trust are subject to creditor claims of the trust maker(s). Although this is true for both separate trusts and joint trusts, joint trusts have a disadvantage in that they keep all assets in the same trust. If a creditor obtains a judgment over either spouse, all assets in the joint trust are at risk for attachment by the creditor. With separate trusts, each spouse’s assets are segregated into a trust for that spouse. If only one spouse becomes subject to a judgment, only the assets held by that spouse are at risk. The assets of the innocent spouse—which are held in a separate trust—are generally out of reach of the creditors of the spouse being sued. This means that separate trusts provide greater asset protection benefits over joint trusts in situations where only one spouse is liable to a creditor. In addition to asset protection during the grantor’s life, assets in a separate trust are even more protected after the grantor of the separate trust dies. At that time, the trust becomes irrevocable, making it even more difficult for other beneficiaries or the surviving spouse’s creditors to reach the property held in the now-irrevocable trust. Asset protection may be of special interest to doctors and other professionals at high risk of being sued for professional malpractice, who may benefit from the added asset protection afforded by separate trusts. Ease of administration at death One of the main problems with joint trusts is the inability to trace assets after one spouse’s death. As assets in a joint trust are bought and sold over time, it can become difficult to identify which assets are treated as belonging to which spouse. In community-property states, it can also become difficult to determine which assets are joint or community property and which are separate property. This process frequently requires careful valuation of the property in the trust as well as executing new deeds for real property, retitling stock certificates, or establishing separate investment accounts to hold the deceased spouse’s separate property. Tracing is especially difficult when joint trusts divide into separate trusts after the first spouse’s death. This requires the surviving spouse to itemize and value the assets that belong in each component after the first spouse’s death. Experience has shown that many surviving spouses simply do not go through this process, resulting in a commingling of assets that is impossible to unwind later. Tracing can be important for both tax and non-tax purposes. For tax purposes, it is important to understand which assets are treated as belonging to the deceased spouse. This can have implications for both basis step-up and federal estate tax purposes. Similarly, if the spouses have different planning objectives, a commingling of assets or failure to separate the estate into separate trusts at death can alter the client’s non-tax estate plan. Many of these issues can be avoided with separate trusts. With separate trusts, each spouse is treated as the owner of the assets titled in that spouse’s trust. Any changes in value or sales or purchases of assets are clearly delineated, regardless of whether they occur before or after the spouse’s death. This makes it much easier to identify the original ownership of the assets and the tax consequences that occur both before and after each spouse’s death. Trust administration after the death of the first spouse can be very simple and straightforward. The only tasks may be notifying the financial institutions of the grantor’s death and providing them with the trust’s new tax identification number in order to properly report tax issues going forward. Flexibility and protection after death Many joint trusts become irrevocable upon the death of the first spouse. Many clients are concerned that the spouse could remarry or favor one child over another. The purpose of irrevocability is to provide the first spouse with assurance that his or her estate planning objectives are ultimately achieved. This assurance comes at the cost of lack of flexibility. If there are changes in the law, finances, or family dynamics after the first spouse’s death, joint trusts that have become irrevocable do not allow the surviving spouse to adjust the estate plan to accommodate these changes. Separate trusts, on the other hand, preserve the ability of the surviving spouse to alter, amend, or revoke the assets held in the surviving spouse’s trust. At the death of a spouse, separate trusts are generally set up to allow the trust assets to be used as needed to support the surviving spouse under the “HEMS” standard (Health, Education, Maintenance and Support), but do not allow the surviving spouse to withdraw trust assets beyond the HEMS standard or redirect the assets of the trust. However, the surviving spouse still has full control over the assets in their own separate trust. By comparison, a joint trust may be set up in one of three ways:

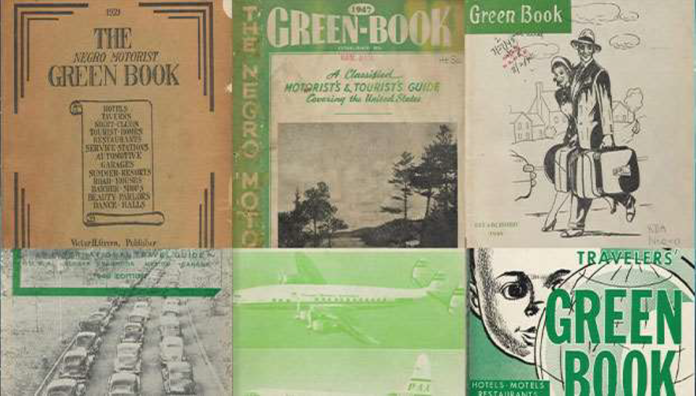

If separate trusts are used, rather than a joint trust, it is possible protect the deceased spouse’s trust assets from being redirected to a new spouse or new children should the surviving spouse remarry, and thus prevents the surviving spouse from disrupting the deceased spouse’s estate plan with regard to the deceased spouse’s assets, without limiting the surviving spouse’s control over their own separate assets in their own trust. Remarriage and Blended Family Benefits Couples who have been married before or who have children from another relationship may also benefit from using separate trusts. This is particularly true when each spouse has property or inheritance that they would like to keep separate for certain reasons. For example, perhaps a newly married spouse has inherited their parents’ home and the couple would like to live there, but the new spouse wants to make sure the family home stays in their own family and passes only to their own children at their death. In addition to a prenuptial agreement, keeping the house in a separate trust would allow this spouse to specify exactly how that home should be used and passed on when they die. Using a joint trust to achieve the same result requires much more careful drafting and introduces a much greater potential for confusion and mistakes in administering the trust after the death of the spouse who owns the house. Cutting-edge research shows that a basic finger-prick blood test may help detect and diagnose Alzheimer’s disease. The findings were recently presented at the Alzheimer’s Association International Conference 2023 in Amsterdam, Netherlands. Like simple finger-prick testing commonly used for diabetes, this new advancement may soon be the most accurate way to identify Alzheimer’s disease. It would be a medical game-changer should these new blood tests be able to accurately diagnose Alzheimer’s disease. Alzheimer’s disease, as defined by the Alzheimer’s Association, is a type of brain disease caused by damage to nerve cells (neurons) in the brain. The brain’s neurons are essential to thinking, walking, talking, and all human activity. About 6.5 million people in the United States (age 65 and older) live with Alzheimer’s disease, according to Mayo Clinic statistics. Since this disease worsens over time, early detection is crucial. These findings are timely and important with the recent U.S. Food and Drug Administration approvals of Alzheimer’s treatments targeting amyloid-beta where confirmation of amyloid buildup and biomarker monitoring are required to receive treatment,” said Maria C. Carrillo, Ph.D., Alzheimer’s Association chief science officer. “Blood tests — once verified and approved — would offer a quick, noninvasive, and cost-effective option.” Before this new possibility of detection through a finger prick blood test, there’s been no single test to determine if a person is living with Alzheimer’s or another dementia. Presently, says the Alzheimer’s Association, medical experts rely on various diagnostic tools combined with medical history and other information. These blood tests could be available for both at-home use and in office use at a medical facility. SOURCE/MORE: AMERIDISABILITY>> During the Jim Crow era, Black Americans traveling the country through segregated America consulted a guidebook - colloquially known as the "Green Book" - to determine which restaurants, hotels and other amenities they could safely visit.

This year, legislation to recognize sites included in the guide with historical markers has been making its way through the General Assembly. Specifically, this legislation is known as House Bill 1968 and directs the Virginia Department of Historic Resources "to designate or approve supplementary signs for historic site signs” identifying locations from the Green Book. The signs would be affixed to the bottom of preexisting silver and black historical markers, similar to signs marking Virginia's historic trails. The bill's patron, Del. Mike Mullin, D-Newport News, told the Senate Committee on Agriculture, Conservation and Natural Resources on Feb. 14, 2023, that the bill would "preserve the memory of those businesses and those sites that served to Black customers throughout the commonwealth and their contributions to African American history." The Green Book, whose full name is "The Negro Motorist Green Book," was published by New York City mailman Victor Hugo Green from the 1930s to the 1960s and provided a list of hotels, restaurants, service stations and other places that were safe for Black people to go to while traveling. In recent years, the guidebook served as inspiration for a 2018 award-winning movie of the same name that helped grow public interest in the book. Mullin, who is also an attorney at Randall, Page & Bruch in Courtland, told the Senate committee that "approximately 315 sites" are listed in the Green Book in "about 56 cities and towns" in Virginia. Mullin added that, of those, there are about 60 that could have markers under HB 1968. "These sites are hugely important to our history and I hope that they get the recognition and protection that they duly deserve," Mullin told the committee. The bill faced no opposition in the committee, with audible laughs from those in the room when committee chair Del. R. Lee Ware, R-Powhatan, asked if anyone was at the meeting to speak against the bill. The committee voted to report the bill unanimously. HB 1968 passed the House of Delegates unanimously in a bloc vote on Jan. 24 before being sent to the Senate, where the Senate Committee on Agriculture, Conservation and Natural Resources reviewed the bill on Feb. 14, 2023. Among those who spoke in favor of the bill before the Senate committee was Elizabeth Kostelny, chief executive officer of Preserving Virginia. The organization, a privately funded non-profit historic preservation organization, previously listed Green Book sites among its compilation of "Most Endangered Historic Places" in 2021. "We named Green Book sites to our 2021 Most Endangered Historic Places in order to raise awareness of this important history. We thank Delegate Mullin for this legislation, and we support it," Kostelny said. Like in the House of Delegates, the Senate committee voted to advance the bill unanimously. HB 1968 was passed unanimously by the full Senate in a bloc vote on Feb. 17, 2023. This amendment provides $50,000 in fiscal year 2024 for the Virginia Tourism Authority and Department of Historic Resources to effectuate the provisions of House Bill 1968 of the 2023 General Assembly to designate or approve signs for historic Green Book locations. The National Academy of Elder Law Attorneys (NAELA) has designated the month of May as National Elder Law Month. Elder law is an area of legal practice that focuses on issues relating to the aging population. Elder law attorneys handle a wide range of concerns surrounding elder care. This may include protecting assets from long-term care, Medicaid planning, financing long-term care, and estate planning.

WHAT DO ELDER LAW ATTORNEYS DO? Elder law attorneys prepare legal documents including Wills, Trusts, and Powers of Attorney. A Will is a vital part of your estate plan and covers things like distribution of your assets and who will act as guardian for your children, things that if you do not prepare ahead of time, the state’s law will decide for you. Powers of Attorney let you give another person the power to act for you if you were to become incapacitated. A trust is a legal document that gives instructions for handling assets. HOW CAN AN ELDER LAW ATTORNEY HELP ME? Elder law attorneys are advocates for elderly individuals and their loved ones. They have specialized knowledge and experience concerning public and private resources and services that can help meet the needs of senior citizens, including those with disabilities. An elder law attorney helps seniors and their families obtain their necessary legal documents and protect their legal rights. While the area of elder law concerns the older population, no matter what stage of life you are in, there are steps you can take to better plan for your future with your elder law attorney. If you are interested in learning more, you can contact the office at 540-962-6181 to schedule an appointment with Jeanne Hepler, who is an elder law attorney. Ms. Hepler is a member of Elder Counsel, WealthCounsel, and the Virginia Chapter of the National Academy of Elder Law Attorneys. With 48 million families supporting someone in long-term care across the United States,* all too often long-term care becomes the target for illegal activity that leaves the families who were simply trying to care for their loved one at a loss. However, you don’t have to become a victim.

TAKE TIME TO UNDERSTAND YOUR LOVED ONE’S ADMISSIONS CONTRACT When securing a long-term care facility for your loved one, you will have to decide whether or not to sign an often lengthy and confusing admission contract. Unfortunately, many caregivers do not understand what they are actually signing, thus providing the perfect opportunity for a facility to add illegal clauses that families unknowingly agree to. For example, some admissions contracts include a clause that states a caregiver must pay the resident’s bill in the event that the resident cannot afford to do so. However, clauses like this are generally illegal. Yet, in the event that you unknowingly agreed to this clause in the admission contract, the nursing home can hire debt collectors, including law firms, to demand that you pay the unpaid bills; sometimes even going as far as personally suing you for the outstanding balance or reporting the debt to consumer credit reporting companies under your name. HOW TO SPOT THE RISKS IN YOUR LOVED ONE’S CONTRACT Oftentimes you may not realize your loved one’s contract includes these clauses until the nursing homes attempts to collect from you personally. If you are already experiencing this pressure from a nursing home, it is important to reach out to a knowledgeable elder law attorney who can review the contract you signed and advise you on the best way to proceed. If you haven’t yet signed a contract, it is a prudent idea to have the agreement reviewed by an expert elder law attorney so they can ensure these clauses are not present. At the very least, pay special attention to verbiage such as “responsible party” or “joint and several liability” in the admissions contract. Some contracts also include language about the caregiver’s liability for a completed Medicaid application or make the caregiver jointly liable with the resident for nursing home bills. In any event, make sure you read the contract thoroughly before you sign it. HOW TO HOLD BAD ACTORS RESPONSIBLE You can report the nursing home for violating the Nursing Home Reform Act. To do that, you will need to contact your state’s nursing home survey agency and file a complaint with your state attorney. Finally, if you are having a problem with a debt collector, you can submit a complaint to the CFPB online or by calling (855) 411-2372. *According to AARP and National Alliance for Caregiving. Caregiving in the United States 2020. Washington, DC: AARP. May 2020. What is the federal public health emergency (PHE) and how does it affect Medicaid members?

The federal government declared a public health emergency when the COVID-19 pandemic began. Since then, state agencies have continued health care coverage for all medical assistance programs, even for people who are no longer eligible. When will normal Medicaid processes begin again? States will have 12 months to make sure Medicaid members are still eligible for coverage even though the Public Health Emergency officially ends on April 1, 2023. However, they will not cancel or reduce coverage for Medicaid members without asking them for updated information. Denials and closures will begin on April 30, 2023, and everyone will be reviewed by March 2024. After March 2024, it will be business as usual moving forward. All renewal Notices of Action will be mailed out this March of 2023 and you will have 30 days to respond once received. You may have a 90-day grace period to respond if you miss the initial deadline for response. However, you will need to reach out to your caseworker to specifically request an extension if you need more time to respond. What can you do now? You can:

What if you lost coverage during the PHE? Anyone who lost coverage during the PHE due to administrative reasons needs to complete and submit the renewal paperwork that is requested. The Department of Social Services will process the renewal applications within 30 days and members can call 1-855-242-8282 with any questions. If you would like additional information, please visit coverva.org or facebook.com/coverva/. You can also call Cover Virginia at 1-855-242-8282 for assistance. |

Collins & Hepler, PLCA small firm with big abilities Archives

May 2024

Categories

All

|

RSS Feed

RSS Feed